The conversation about the future of real estate to date has largely focused on technology and how new platforms and programs are changing the work that agents do – albeit grudgingly.

In these conversations, embracing innovation is seen in terms of large-scale change, major disruption, overcoming objections and tough conversations with staff who resist.

The management challenge has been identifying the technology that will allow us to do the work we’ve always done in a faster, better, more efficient way and to work out how to bulldoze our way through objections with claims that it’s the only way to survive or its what our customers want.

But what if we’ve been doing it all wrong?

Last year, Grenville Turner, former CEO of the UK real estate group Countrywide, spoke at the Macquarie Perspectives conference. His key messages have stayed in the background of my thinking all year, connecting with other insights from training on leadership (thanks Tanja M Jones!) and INMAN Connect in San Francisco.

The business model is broken

The conclusion I’ve drawn is that if a business process or model is broken, focusing on a technology fix and then trying to deal with the human cost is – quite simply and plainly – all arse about.

If the business model is broken, then adding technology to make us more efficient, faster and better is really just adding technology that will amplify what’s wrong. It’s just going to make us fail faster – but not in a good way. This is the pain I hear that many real estate agencies are feeling in spades.

But rather than treating the symptoms, it’s time to treat the cause. What is the real cure?

Well, it’s about taking the focus away from ourselves and our own problems, and focusing on our customers and what they are experiencing.

The success of such an approach can be seen in the experiences of Countrywide in the UK during the GFC and a host of agencies across Australia that have pivoted their businesses. The data that shows why it works is backed by the research I did on customer experience with the Perception series while at CoreLogic.

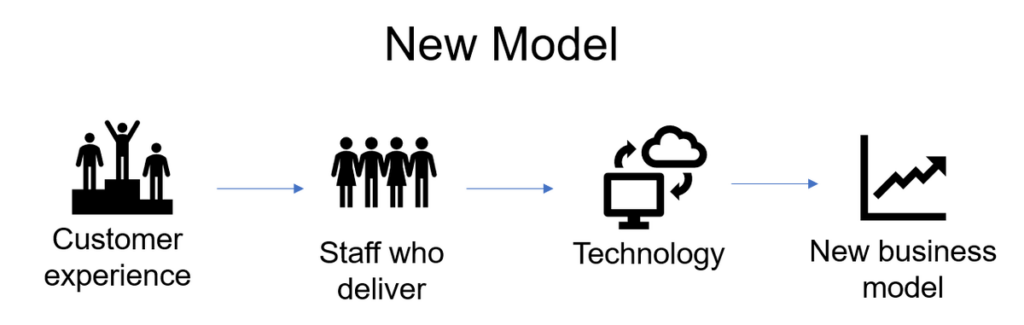

Time to focus on a new model

Turner outlined a new model that he implemented while at Countrywide that put customer experiences – and in particular, buyers – at the centre. His new model recognised that commissions on sales and rentals was insufficient as a revenue stream, especially in a declining market. (sound familiar?)

When a buyer was identified as interested in a property by one of Countrywide’s 12,000 employees, they became the centre of attention. Staff focused on understanding exactly where the buyer was at with their home buying journey and what they needed as the next step and delivered to those needs the entire way along.

The conversation would go something like this:

“If we saw someone looking in the window, or if they made an inquiry, we’d agree it was a lovely home, and ask if they had their finance organised before we would show it to them,” Turner explained.

“We’d tell them: “We wouldn’t be doing the right things by our vendors if we took the property off the market because we accepted an offer and it fell through because the finance wasn’t set up properly.”

Putting the buyer at the centre

The conversation would then help the buyers identify how much they’d need to borrow to buy the home and provide them with some financing options (which they did not need to take, but which was often useful for them to take to their own bank as a comparison).

The model proved so successful, that Countrywide soon expanded it to include questions about insurance, life insurance (the UK equivalent to a requirement for mortgage insurance), conveyancing services, and then later connection services. With each transaction, Countrywide received a payment, and this was explained up front to customers.

Far from doing their vendors a disservice by reducing the number of viewers through a home, the service levels to sellers increased because the conversion rate of viewers to purchasers increased.

“For every pound selling a house, we wanted to make 50p from complementary services,” Turner said. And Countrywide did.

Added value services

Setting up services for renters to deliver gas, power, broadband for which they were paid a commission by the providers, quickly became a $2m annual business for Countrywide. Filling in tax returns for landlords each year added another $4m to the bottom line.

By delivering amazing complementary experiences and services – even to the people who were not traditionally their market – Turner grew his own stake in the business from 1.25m pounds to more than 17.5 million.

The Perceptions researched shows that the Australian market is ripe for a similar revolution in business model. The research reveals that there is a hierarchy of care in the vast majority of real estate agencies across the country, where vendors are prized above all, followed by landlords, and then a big drop off to buyers and tenants a long way fourth.

The broken business model of sales and rental commissions means we focus on segmenting our relationships with an outdated method that says there are four ‘types’ of customers from whom we either can or can’t make money from.

One client, four relationships

In reality, there is one customer pool of people who are going through four different stages of the property lifecycle. And our business models need to be mature enough to have financially viable relationships with them at every stage.

“It’s not about new technology,” Turner said. “It is about combining all existing technology in new and innovative ways that are making a difference.”

“Change is happening,” he said. “We need to be customer driven, understand that transparency wins and seize the opportunity.”

2019 needs to be the year of the new business model in real estate. I don't believe we can wait any longer. What do you think?